income tax calculator indonesia

Thus resident taxpayers have to calculate and settle ie if the Annual Individual Income Tax Return AIITR is showing underpayment amount and submit for the AIITR accordingly. 2500000 but does not exceed Rs.

Pin By Gadai Bpkb Mobil Cepat Indones On Gadai Bpkb Mobil Cepat Indonesia Bunga Rendah Budgeting Debt Consolidation Loans Money Savvy

In-kind benefits paid for by the employer such as.

. Given the consequences of non-compliance foreign workers should seek help from registered local tax advisors to better. Similarly a foreign company that has a permanent establishment in Indonesia - and carries out business activities through this local entity - falls under the Indonesian tax regime. A flat CIT rate of 22 applies to net taxable income.

For example your salary was 2090000 then youd have to pay 5 on the first 1950000 and 10 on the last 140000. Individual income tax IIT for employees in Indonesia social security costs capital gains tax payroll tax. 3500000 the rate of income tax is Rs.

Indonesia Income Tax Calculator. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Personal income tax in Indonesia is determined through a self-assessment system meaning resident tax payers need to file individual income tax returns.

2 x 600000000 12000000 Personal allowances 54000000 3 x 4500000 67500000 Pension contribution. The primary concerns for a foreign company that needs to comply with tax laws in Indonesia are. Taxes for Year of Assessment should be filed by 30 April.

Non-residents are subject to 20 withholding tax on any income sourced within Indonesia. The tax authorities have the right to audit any tax return to ensure the individual has correctly calculated the tax payable within the 5-year statute of limitations. In addition to salary taxable employment income includes bonuses commissions overseas allowances and fixed allowances for education housing and medical care.

Indonesian Tax Guide 2019-2020 9 3. The calculator only includes the individual tax free allowance of IDR 24300000. How to calculate the total cost of import in Indonesia.

Corporate Income Tax. Indonesian tax resident and non-resident taxpayers who have Tax Identification Numbers Tax-ID are generally taxed on a. 2500000 the rate of income tax is Rs.

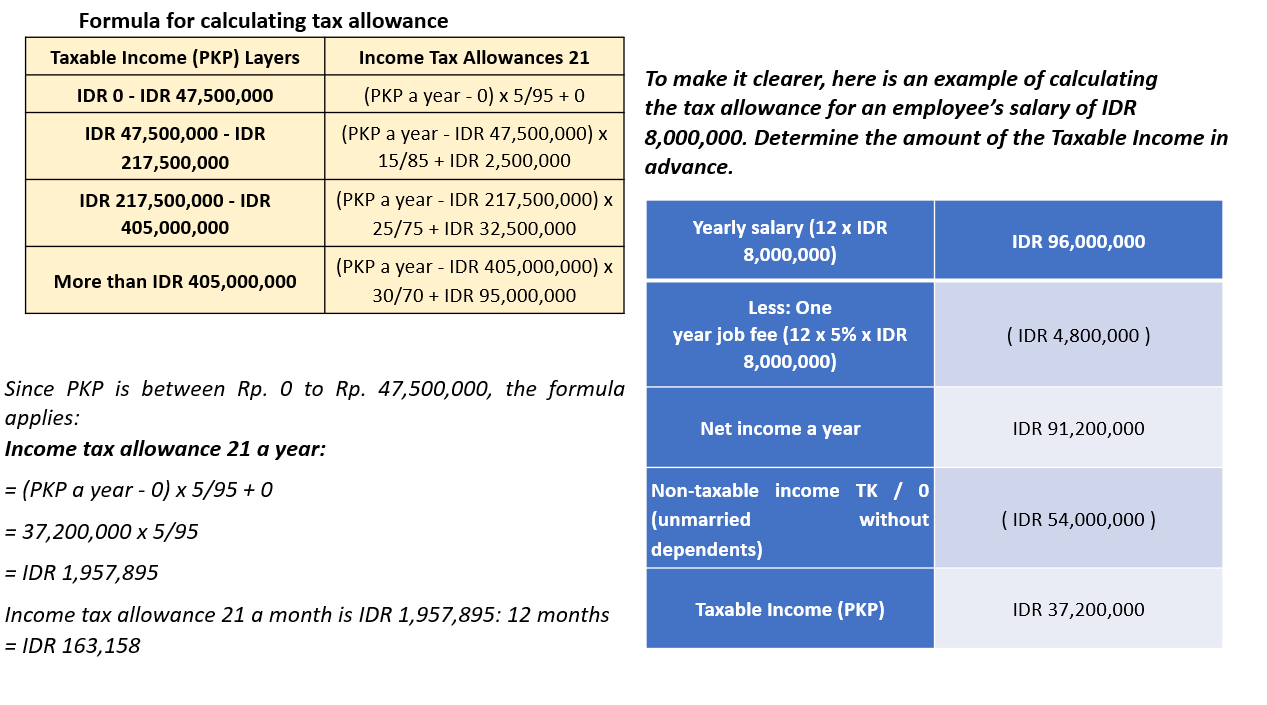

This amount needs to be calculated per salary segment using that table. Indonesia adopts a self-assessment system. 21 Income Tax rates.

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for. There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with. Indonesian residents qualify for personal tax relief as seen in the table below.

Where the taxable salary income exceeds Rs. Calculate Employee Income Tax in Indonesia. There are a variety of other ways you can lower your tax liability such as.

To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA. 2 1 8939700 178794.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. The tax office requires all expatriates resident in Indonesia to register with the tax office and obtain their own separate tax number NPWP and pay monthly income taxes file annual tax returns and pay tax on their income earned outside Indonesia less tax paid in other jurisdictions on the additional overseas income. 90000 15 of the amount exceeding Rs.

10000 20000 30000 40000 50000 60000 70000. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Employment income in Indonesia is subject to tax regardless of where the income is paid.

Where the taxable salary income exceeds Rs. The calculator is designed to be used online with mobile desktop and tablet devices. More information about the calculations performed is available on the about page.

195000 175 of the amount exceeding Rs. Except for self-assessed VAT on utilization of intangible taxable goods andor. If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000.

Annual gross income. In Indonesia tax services are provided by Deloitte Touche Solutions. Occupational expenses 5 from gross income or maximum 6000000 6000000 Old age saving contribution paid by employee.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions. A company is subject to the tax obligations set by the Indonesian government if the companys domicile is in Indonesia.

9172021 0 Comments Similar to the severance payments made in year three and onwards the gross income is taxed at the normal IIT ratesIt is crucial to do the reporting correctly to avoid penalties and additional expenses. Review the full instructions for using the Indonesia Salary After Tax Calculators which details. This is an income tax calculator for Indonesia.

Our calculation assumes your salary is the same for and. TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. This includes corporate income tax personal income tax withholding taxes international tax agreements value-added tax VAT and many more.

Resident tax payers are subject to progressive tax rates ranging from 5 percent to 30 percent. 1800000 but does not exceed Rs. Taking advantage of deductions.

Corporate income tax CIT rates. Foreign companies without a PE in Indonesia have to settle their tax liabilities for their Indonesian-sourced income through withholding of the tax by the Indonesian party paying the income. The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income.

Annual Tax Exempt Income This field is adjusted toward your status Eg. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. There are specific rules for payroll and taxation in Indonesia depending upon whether your company employs foreign nationals or local Indonesian employees.

Indonesia - utilizes the self-assessment method for individuals to calculate settle and report income tax. The Income Tax calculation is based on your Taxable Income minus the Standard Personal Deduction which is equal to 380000Y.

Personal Income Tax Calculator In Indonesia Free Cekindo Di 2021

Pengenaan Tarif Pph Final Pada Wp Dengan Penghasilan Bruto Tertentu

Jember East Java Indonesia June 14 2018 Yoga Journal App In Play Store Close Up On The Laptop Screen Ad Journal App Business Brochure Brochure Template

Taxation System In Indonesia Your Guide To Income Taxation

Pin On The Idea Is To Transcend All Before All Rise Above All Till The Sky Atop

Standard Vat Rate Indonesia 2021 Is 10 In 2021 Indonesia 10 Things Calculator

Personal Income Tax Calculator In Indonesia Free Cekindo

Did You Know About This Latest Update Related To Income Tax Gaurav Jindal And Associates In 2022 Income Tax Business Advisor Income

Indonesia Payroll And Tax Guide

When Do You Need To File Your Taxes Check Here Infographic Tax Season 2014 Filing Taxes Singapore Business Business Infographic

Indonesia Salary Calculator 2022 23

Taxes Are Going Up What Can You Do To Bring Them Down Click Here For More Information Http Bensalemcomfort Com Even Tax Lawyer Tax Preparation Accounting

Calculate Employee Income Tax In Indonesia Blog Gadjian

Personal And Corporate Income Tax Indonesia How To Calculate It

Notice For Malaysia Service Tax On Imported Taxable Services E Spin Group Tax Indirect Tax Awareness

Taxation System In Indonesia Your Guide To Income Taxation

Senior Tax Manager Job Description Example Job Description And Resume Examples Income Tax Return Income Tax Irs Taxes