japan corporate tax rate 2022

The rate is increased to 10 to 15 once the tax audit notice is received. Bangladesh raised its rate from 25 to 325.

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is.

. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. Warren Buffett quietly boosted his Japan bets warned about Fed rate hikes and defended his tax contributions. In 2021 20 countries changed their statutory corporate income tax rates.

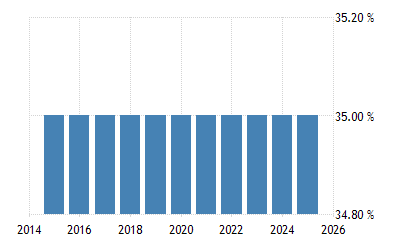

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy on corporate inhabitant tax for each taxable year are shown below. Local management is not required. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Exact tax amount may vary for different items. By Syndicated Content Feb 3 2022. Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022.

The standard deduction amounts will increase to 12950 for individuals and married. This page provides - Japan Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Personal Income Tax Rate in Japan is expected to reach 5597 percent by the end of 2021 according to Trading Economics.

There are seven tax rates in 2022. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. VAT and Sales Tax Rates in Japan for 2022.

Representing almost 1 of the total corporate income. 10 12 22 24 32 35 and 37. By Syndicated Content Feb 3 2022 630 PM.

Business tax comprises of regular business tax special local corporate tax and size-based business tax. Combined Statutory Corporate Income Tax Rate. He told NBC News earlier this month that hes onboard with a 15 corporate minimum tax a 28.

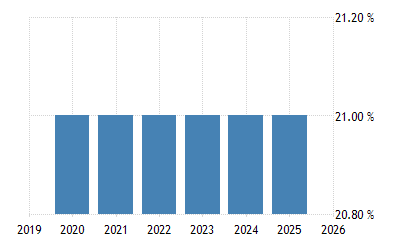

Japanese is not considering reviewing future national sales tax rates as the current. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models. United States Corporate Tax Rate was 21 in 2022.

167 rows Corporate Tax Rates in 2021. Shunichi Suzuki told reporters after a cabinet meeting that Japan must. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Corporate and international tax proposals in tax reform package 19 December 2018 The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax measures. About 5 tax on a 100 purchase. Three countries increased their corporate tax rates.

The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the. TOKYO Reuters Japanese is not considering reviewing future national sales tax rates as the current 10 levy provides a vital source of funding the social security spending to support its ageing population the finance minister said on Friday. Heres how they apply by filing status.

Manchin has said he backs hiking the corporate tax rate to 25 as part of a future spending bill. Japan has no plans to review sales tax rates finance minister says. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

United Arab Emirates 1605 GDP YoY Forecast. In the case that a corporation amends a tax return and tax liabilities voluntarily. Japan VAT Rate 500.

6 rows Unit. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Argentinas from 30 to 35 and Gilbratars from 10 to 125.

Japan Personal Income Tax Rate - values historical data and charts - was last updated on March of 2022. An under-payment penalty is imposed at 10 to 15 of additional tax due. Japan has no plans to review sales tax rates finance minister says TOKYO Reuters Japanese is not considering reviewing future national sales tax rates as the current 10 levy provides a vital source of funding the social security spending to support its ageing population the finance minister said on Friday.

It depends on companys scale location amount of taxable income rates of tax and the other. Bangladesh Argentina and Gibraltar.

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Corporation Tax Europe 2021 Statista

Corporate Tax Reform In The Wake Of The Pandemic Itep

Micronesia Business Gross Revenue Tax February 2022 Data 2020 2021 Historical

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Japan S Carbon Tax Policy Limitations And Policy Suggestions Sciencedirect