salt lake county sales tax rate

Salt Lake County Awarded 150000 to Serve Newly Arrived Afghan Refugees. This is the total of state and county sales tax rates.

Fast Easy Tax Solutions.

. The Salt Lake County sales tax rate is. The Utah state sales tax rate is currently. The current total local sales tax rate in Salt Lake.

The various taxes and fees assessed by the DMV include but are. 91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions. HH County Airport Highway Public Transit AT Transportation Infrastructure SM Supplemental State Sales Use Beaver County 01-000 470 100 025 595 Beaver City 01-002 470 100 025 100 695 Milford 01-008 470 100 025 595 Minersville 01-009 470 100 025 595 Box Elder County 02-000 470 100 025 595.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. 3 rows The current total local sales tax rate in Salt Lake County UT is 7250. The Utah sales tax rate is currently 485.

Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you pay property taxes on 55 of your homes value. The Salt Lake County Sales Tax is 135. Did South Dakota v.

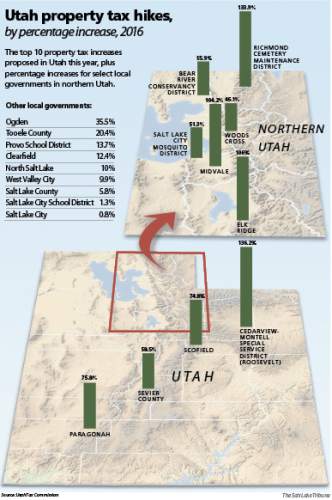

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Tax sale will be online through Public Surplus. The certified tax rate is the base rate that an entity can levy without raising taxes.

Average Sales Tax With Local. Salt Lake County Puerto Rico Sales Tax Rate 2022 Up to 875. The project will serve up to 550 Afghan refugees who have arrived in Salt Lake County.

For additional information contact 385-468-7200. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. These are all NO RESERVE auctions.

The County sales tax rate is 135. For tax rates in other cities see Utah sales taxes by city and county. A single 500 deposit plus a 35 non-refundable processing fee is required to participate in the Salt Lake County UT Tax Sale.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. None of the cities or local governments within Salt Lake County collect additional local sales taxes. Ad Find Out Sales Tax Rates For Free.

How is the value of my property determined. The current total local sales tax rate in Draper UT is 7250. The December 2020 total local sales tax rate was also 7250.

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Salt Lake City UT Sales Tax Rate. This page contains an overview of the sales business and personal tax rates in the state of Utah based on 2011 data.

Utah Sales Tax Sales taxes are applied to a variety of goods including tangible personal property transportation services hotels and food. 500 deposit required to bid on properties. Salt Lake County UT Auditor is offering 253 parcels for auction online.

A county-wide sales tax rate of 135 is applicable to localities in Salt Lake County in addition to the 105 Puerto Rico sales tax. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. To participate in the tax sale bidders must register a week in advance in order to process their bid deposit.

The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Salt Lake City Utah is 775. This is the total of state county and city sales tax rates.

Welcome to the Salt Lake County Property Tax website. The current total local sales tax rate in North Salt Lake UT is 7250. In other words it is the rate that will produce the same amount of revenue that the entity budgeted.

The minimum combined 2022 sales tax rate for Salt Lake County Utah is. The Salt Lake City sales tax rate is 05. The December 2020 total local sales tax rate was also 7250.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. You can print a 775 sales tax table here.

Utah has state sales tax of 485 and allows. Bids start as low as 2700. Salt Lake County Mayors Office for New Americans ONA was awarded a 150000 Open Society Foundations grant for Operation Afghan Refugee Support OARS.

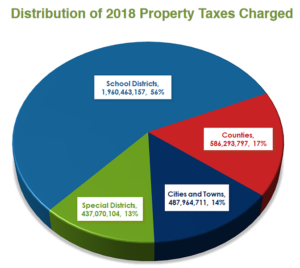

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Utah Sales Tax Small Business Guide Truic

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Unaffordable Utah Salt Lake County S Apartment Market The Tightest In History

Sales Taxes In The United States Wikiwand

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Sales Taxes In The United States Wikiwand

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Sales Taxes In The United States Wikiwand

Utah Sales Tax On Cars Everything You Need To Know

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Sales Taxes In The United States Wikiwand

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Utah Sales Tax Information Sales Tax Rates And Deadlines

Property Taxes In Hawaii How It Compares To Other States